Meat-free meat – food manufacturing IP analysis

Veggie burgers that bleed? Mainstream veganism? Odd concepts to many—but could they one day become reality? Reports suggest they’re closer than you might think.

There are an estimated 400 million (and growing) vegetarians around the world. Nestle predicts that, by 2020, plant-based foods will become a $5 billion market in the US.

Using intellectual property (IP) data, we’ll look at the future of meats free from animal products—but first a little background.

Consumer diets and ethics are evolving

Vegans were considered a bit of a joke 20 years ago—I know because I was vegan then. A quick scan through today’s bestselling cookery books shows that people are becoming much savvier (some might say militant) about what they ingest. Diet trends have changed considerably.

Low/no-alcohol beer, plant-based diets, eating clean and raw, unprocessed foods all have purported additional health and nutritional benefits. And ethical sourcing of produce has become more prominent in the minds of consumers. This year, if you weren’t having an alcohol free month for Dry January, you were possibly trialling an animal-free diet for Veganuary.

Off the back of this evolution in eating habits en masse there’s an opportunity to capitalise. Now could be the time to advance meat production and either make it much more ethical or eliminate it altogether.

And that’s a market well worth sinking your teeth into.

The problem

Omnivores like meat, but there are limited ways food manufacturers have been able to provide that meaty experience without including actual meat. Replacing meat with vegetables, fungi or pulses seems to be the traditional approach.

You can fix the flavour part relatively easily—although flavour specialists such as Firmenich are constantly refining this too. But appearance and texture seem to be a bit more challenging.

And chicken ain’t chicken until it tastes, looks and feels like chicken.

And then there are other problems—like beef, pork, lamb and fish. Will we ever get to enjoy a nice, juicy, medium-rare steak without killing a cow in the process?

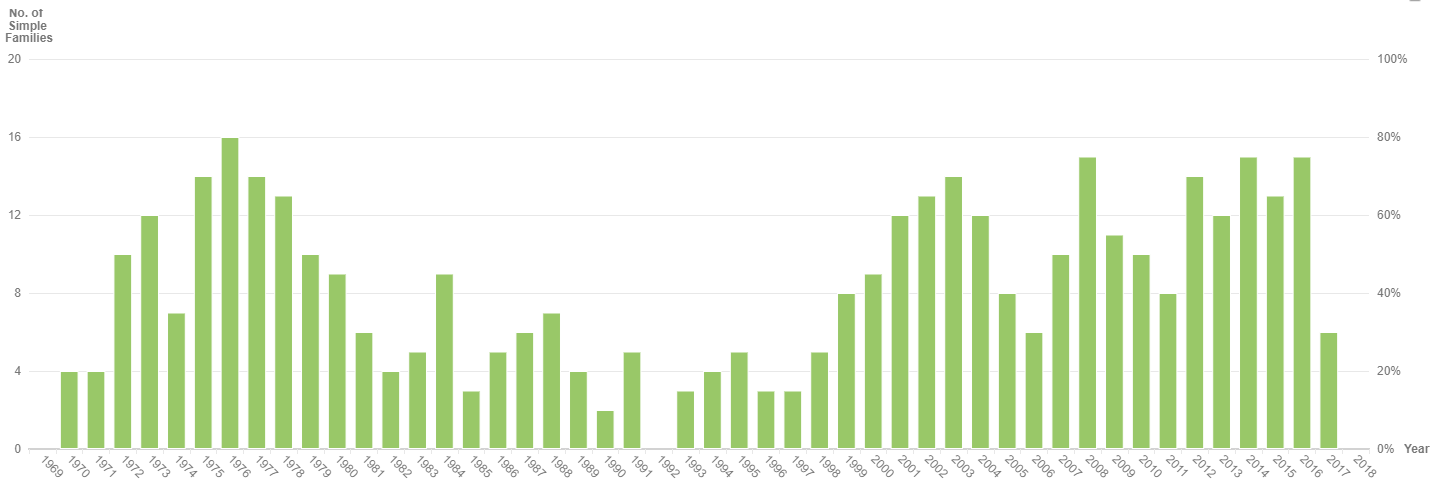

But meat-free meat isn’t a new concept. Patent records dating back to 1970 show that creating great meat alternatives has been, and still is, on the radar for some food manufacturers. And while the 80s and 90s proved to be a low point for this area of innovation, there seems to be a slow yet steady increase in activity overall—albeit with a couple of dips in the last 15 years.

Quorn—meat-free pioneers

Back in the 1980s ICI and Rank Hovis McDougall got together to set up Marlow Foods. The mission was to create an alternative and sustainable protein food source to meat. Et voila, Quorn was born in a North Yorkshire lab. Quorn—in short—is fermented soil fungi called mycoprotein. If you forget about Tofu (fermented bean curds that have been eaten for around 2000 years), Nattō (1000 years) and Tempeh (200 years)—this was a real revolutionary step for vegetarians.

Mouthfeel was the key to conquering this market. Mycoprotein bound with egg whites created textures not totally dissimilar to meat. Add in some meat inspired flavourings and you’ve got a more-than-adequate meat alternative. 30 odd years later, Quorn is the clear market leader of textured meat-free alternatives. There’s now a vegan version of Quorn using potato protein.

Marlow foods patented the tech behind Quorn production and gained a 20-year advantage over the competition, but those original patents have now, long expired. This means that anyone, from students to Big Food Inc, could replicate Quorn’s early production methods.

A basic patent search looking at edible mycoprotein reveals 59 patents – a quarter of which belong to Marlow Foods. Many of the others are for animal feeds. It seems strange that big food enterprises Mondelez, Unilever, Associated British Foods et al appear to be stepping to one side and not taking advantage of this freedom to operate – as evidenced by their product lines.

Interestingly, reports show that a University of Strathclyde spin-off, 3fbio, has found a way of halving production costs for mycoprotein and as a bonus it reduces waste byproducts. US20170226551A1 – ‘Bioprocess for coproduction of ethanol and mycoproteins’ provides a potential licensing opportunity for Marlow Foods to collaborate on and could strengthen its hold on this market sector.

It’s clear that any potential usurper of Marlow Foods is battling 20 years of experience and a company with the ability and desire to adapt and improve the product—including creating vegan lines and refining ready meals. Plus, a large part could be down to Marlow Food’s marketing—helped by brand ambassadors like Mo Farah and Adam Peaty—which has grown Quorn’s customer appeal to include more than vegetarians. It’s become a genuine meal/meat alternative for peak performers.

Will this food revolution be the catalyst for major food manufacturers around the world? The recent patent activity from innovators in this field reveals signals about how this market and its technologies are evolving.

This is just a taster of the insights PatSnap can provide for you and your business

Would you like a free personalised tour?

Where’s the next big food manufacturing breakthrough?

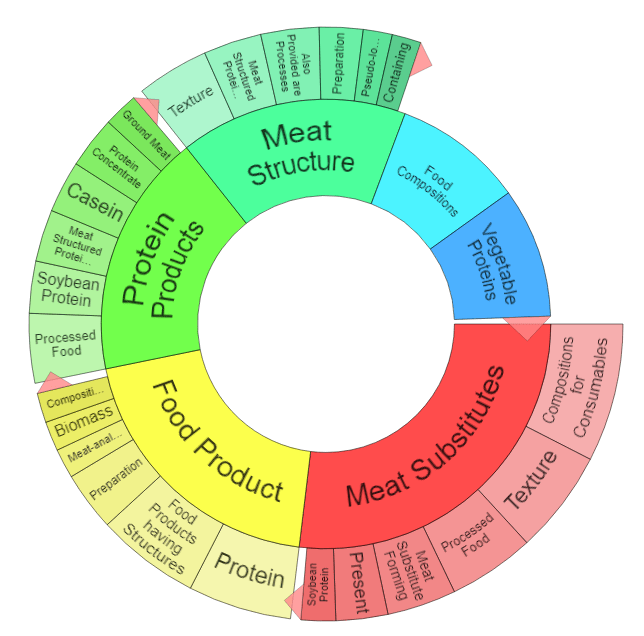

The following section looks at the results of a query investigating meat substitutes (often referred to as meat analogues)—that concentrate primarily on texture.

(TAC:(“meat” $W0 (“substitute” OR “replacement” OR “structured” OR “synthesised” OR “faux” OR “mock” OR “alternative” OR “analog” OR “analogue” OR “artificial” OR “replica” OR “replicas”))) AND (((“meat” $W8 (“composition” OR “consistency” OR “character” OR “constitution” OR “structure” OR “texture” OR “mouthfeel” OR “mouth-feel” OR “mouth feel”)))) AND (((“meat” $WS (“composition” OR “consistency” OR “character” OR “constitution” OR “structure” OR “texture” OR “mouthfeel” OR “mouth-feel” OR “mouth feel”)))) NOT TAC: (“tater tot” OR “dog meat” OR “pet food” OR “companion animal” OR “veterinary”) IPC: A23

The initial query returned 415 simple patent families.

Companies developing meat substitutes

Innovation and filing trends

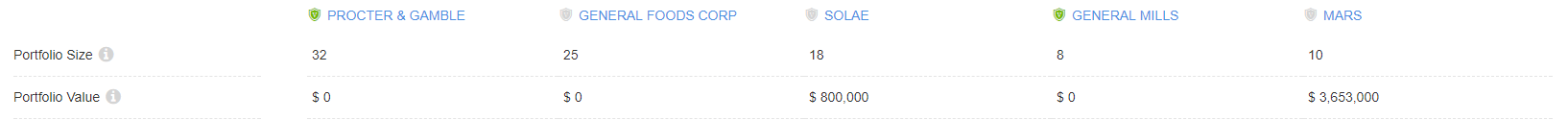

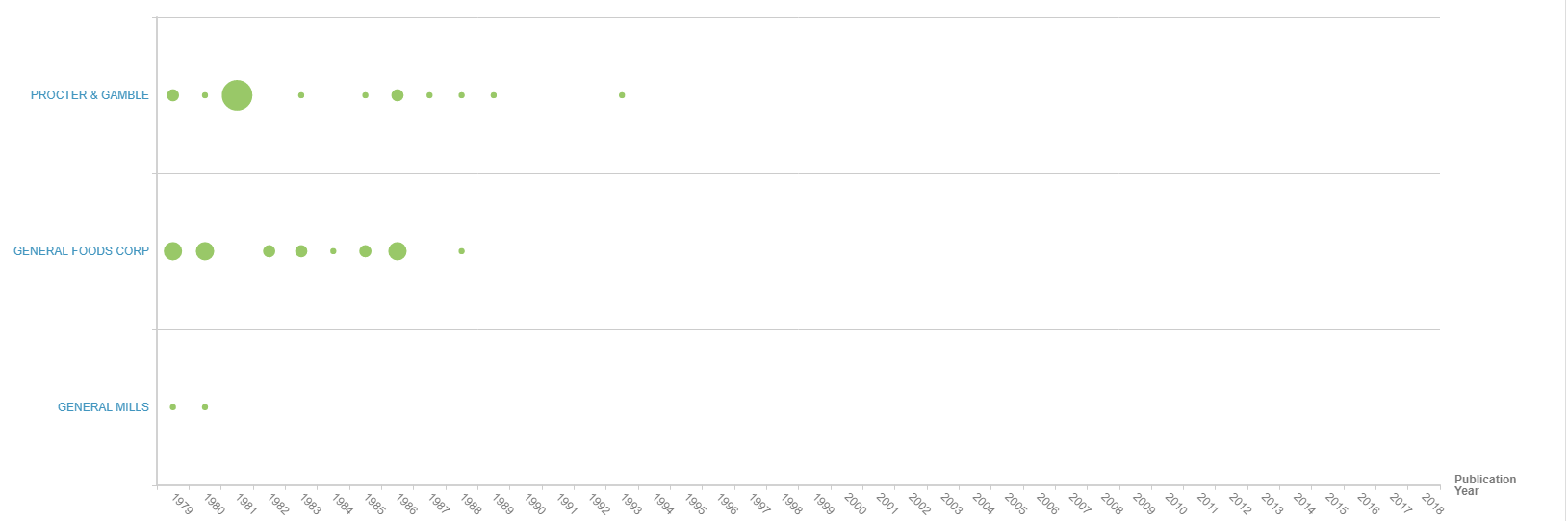

The list of top 5 patent-intensive companies in this area includes Procter & Gamble, General Foods and General Mills—with a combined innovation footprint across 67 simple patent families.

You may or may not be surprised to see these names here. You may or may not be surprised to read that no patents—relating to texture-driven meat replicas—have been filed between Procter & Gamble, General Mills or General Foods since 1993. Are the big food enterprises holding some trade secrets? If this is the case they are keeping those products secret too. It’s feels more like they just gave up on this marketspace. Which gives an impression that this could be a fairly dormant technology.

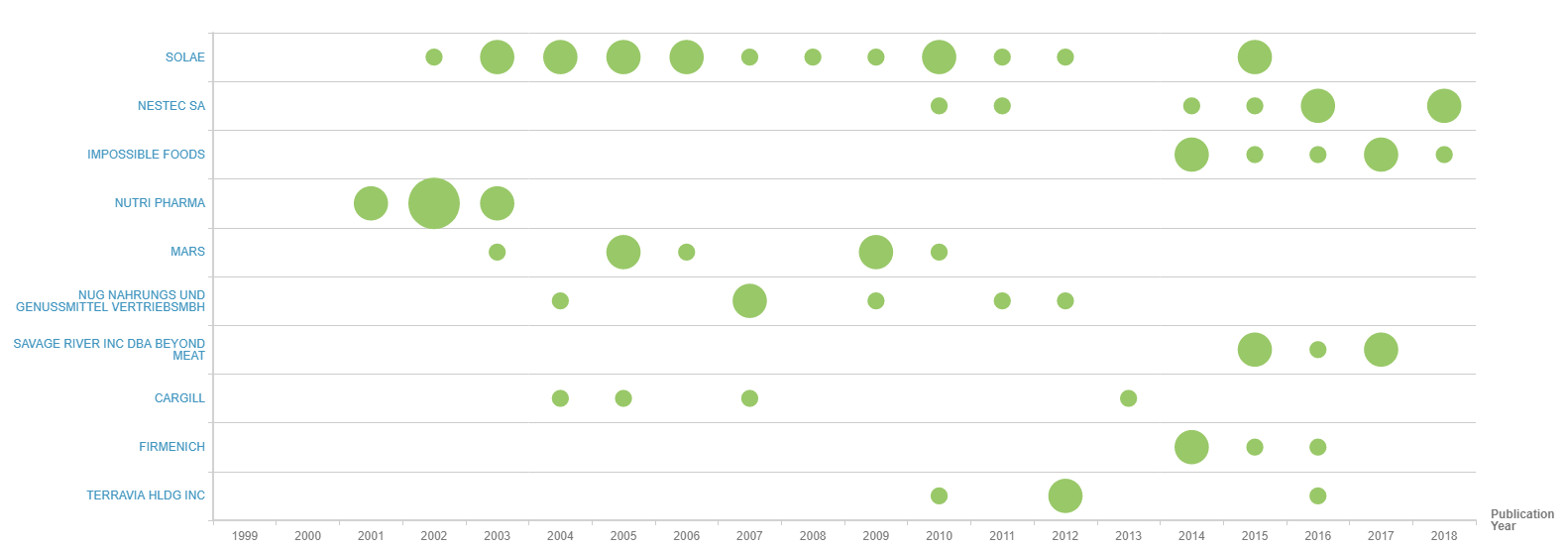

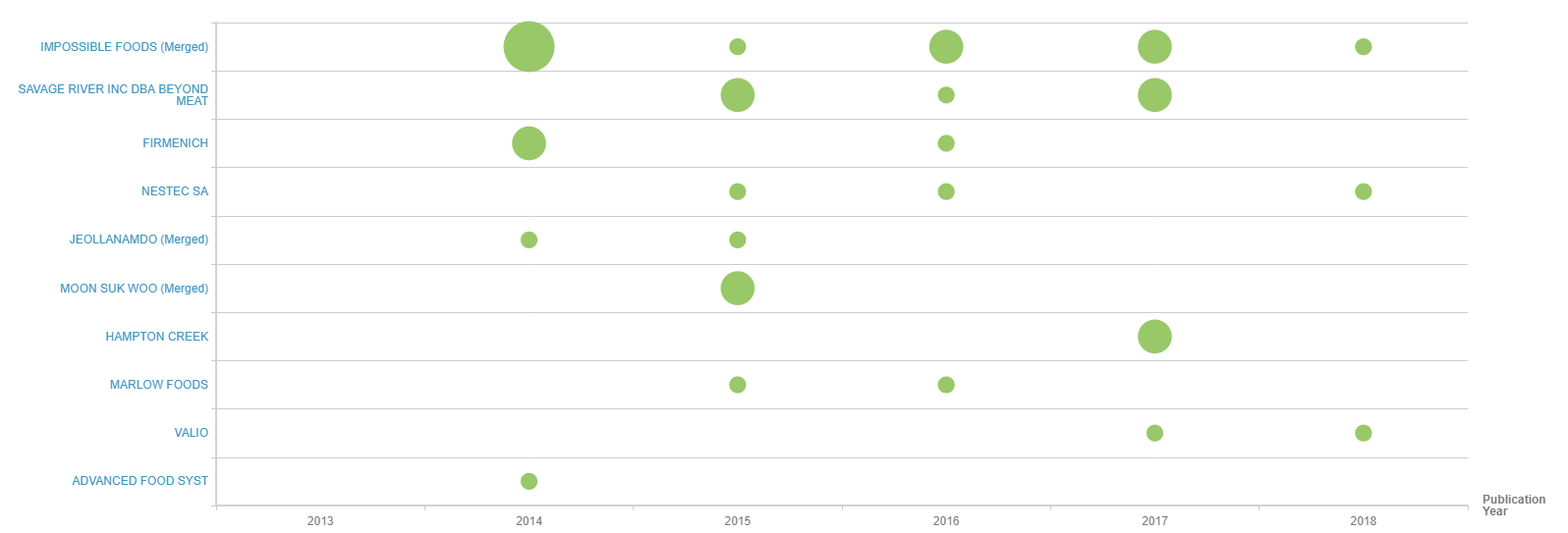

Looking at companies with the highest amount of patenting activity in the last 20 years we can see that only a few businesses are actively protecting tech relating to this area—with a drop off around 2011 from the more experienced companies involved. It’s worth noting that the largest circles in these graphics below represent 3 patents per application year.

Active players

So who are the active players? Focusing our search on the last five years changes the landscape slightly—and it reveals only 62 simple patent families. This seems like an industry ripe for the right business to shake it up. Are these the new gastronomic genii to save the planet one drumstick at a time?

Impossible Foods

Founded in 2011, California based Impossible Foods has been making recent headlines for its burgers that “bleed”. Some patents for Impossible Foods sit under the assignee name of Maraxi. The bleeding and meaty flavour secret is iron-rich Heme—the red pigment in blood, also found in Leghaemoglobin, isolated from soy plants. As for texture, this is down to isolated and purified proteins from various plant sources replicating muscle, connective tissue, fat and flesh.

Savage River (Beyond Meat)

Founded in 2009, California based Beyond Meat is asking why you need an animal to create meat? Using science they are building “meat directly from plants”. This means they are embarking on a mission to create meat analogue that mimics the traits of animal meat—colour, malleability and use versatility, plus the changes in attributes associated with cooking.

Firmenich

One of the largest flavour and fragrance companies in the world—Swiss based Firmenich, has been trading since 1895. Firmenich’s patents are working on ways to pack meat-textured food full of flavour.

Nestec

Nestlé’s Swiss based research and development wing. Known for coffee, baby formula, confectionary and pet food. However it is worth noting one patent referring to a wet extrusion process. In it, it discusses how to turn vegetable protein compositions such as soy protein into a fibrous, meat-like structure. Nestlé also acquired Seitan loving Sweet Earth Natural Foods in 2017.

Hampton Creek

Founded in 2011, California based Hampton Creek has recently rebranded as JUST—although formerly known as Beyond Eggs (but no relation to Beyond Meat). There’s a clue in the old name as to the early goals—products include eggless mayo and eggless scrambled eggs—just requiring a more diverse name for the expanding business.

Hampton Creek’s patents refer to isolating adzuki and mung beans for their meat-like creations.

Moon Suk Woo

Looking outside of the top patentees I spotted Moon Suk Woo. There’s very limited info about Moon Suk Woo online in English (read: none—I’m assuming it’s a company, but may be an individual). It is South Korean based and its patents are for pork cutlet substitutes—which seems ideal as pork is the world’s most popular animal meat and 59% of South Korea’s meat consumption is pork based.

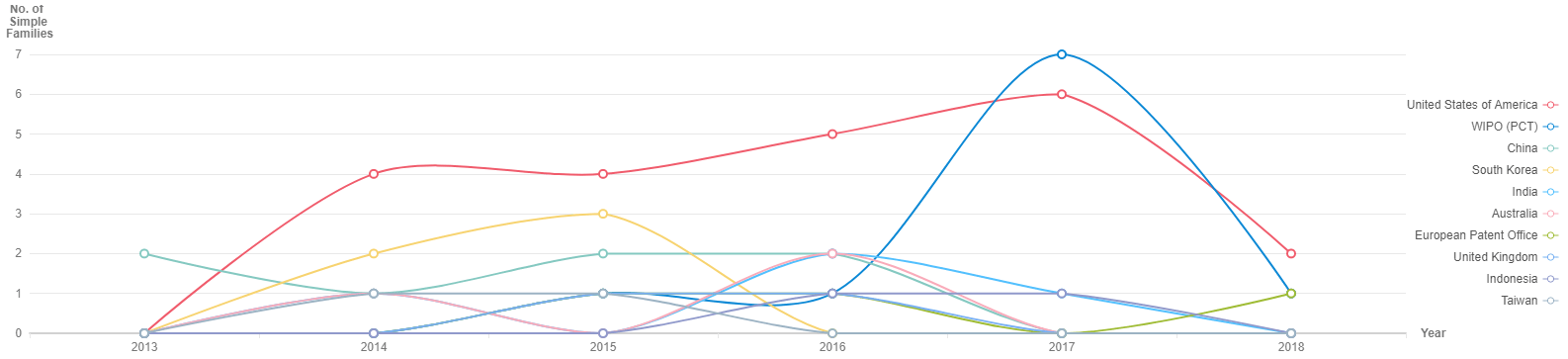

Annual geographic filing trends

When reviewing the patent filing strategies of companies in a specific area of research, it is helpful to understand which markets the focus for technology development and commercialisation are in.

The chart above shows that the largest volume of patent filings in recent years has come from the US patent office. This may suggest latent demand for meatless meats in this market. But there is clearly activity globally according to WIPO patent filings.

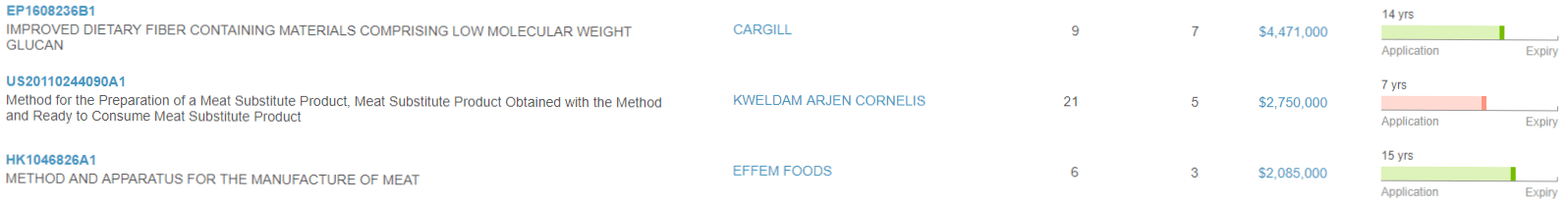

Highest market valued patents

Identifying and understanding the highest-valued patents within a field can indicate which technologies and concepts hold the greatest growth potential. This also shows when highly-valued patents are set to expire, empowering anyone to exploit these technologies once IP restrictions lapse.

Reviewing the three most valuable patents in this space reveals that all three are due to expire within the next 6 years. The top patent— EP1608236B1 – “Improved dietary fiber containing materials comprising low molecular weight glucan”— owned by Cargill, discusses adding nutritional value to food and beverage products containing dietary fibre compositions. This patent is part of a large family, with filings at many different patent authorities, which means that Cargill has made significant investment in protecting this innovation.

This is just a taster of the insights PatSnap can provide for you and your business

Would you like a free personalised tour?

Impossible Foods, Beyond Meat and JUST have a long way to go before they will dethrone Quorn. But this Californian brigade is leading the latest meatless meat revolution—and there is some strong investment support including Richard Branson and Bill Gates.

I’m not convinced that plant protein masquarading as meat is quite primed to convert the mainstream yet. Perhaps that’s a job for lab-grown clean meat?