Under Armour – sportswear manufacturer IP analysis

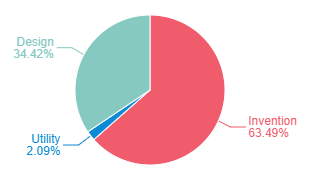

A company portfolio analysis for Under Armour reveals 430 patents. Over 54% have already been granted and almost 27% are still awaiting approval. It’s a modest intellectual property portfolio, with around a third protecting its designs. It also shows that Under Armour’s patenting activity is growing and changing with the times.

(Image source: Maryland GovPics)

We explore how intellectual property insights could level the playing field for a sports clothing and apparel firm against some long established competitors.

(Image source: Maryland GovPics)

Under Armour Inc.

Overview

In 1996, Kevin Plank—Under Armour’s founder—was sick and tired of exercising in heavy, sweat logged t-shirts. So, Plank started developing moisture wicking, compression base-layers from synthetic fabrics in his grandmother’s basement. The idea got traction, sales grew and Under Armour (UA) started making a dent into the sportswear market. It didn’t take long for the market leaders, Adidas and Nike, to cotton—or should that be synthetic fibre—on to the game and produce their own. But UA had already laid down a marker in their territory.

Move forward 22 years and Under Armour have diversified their product lines. From the state-of-the-art research lab in Baltimore, Maryland—known as the Lighthouse—product development looks more like a science experiment. Footwear, bags and sports apps are just as likely to carry the distinctive UA logo as its underwear. And Dwayne ‘The Rock’ Johnson, Lindsey Vonn, Andy Murray, Cam Newton and Gisele Bündchen are just a selection of Under Armour’s brand ambassadors.

With annual sales of over $4.8 billion and a market cap of $10.1 billion, UA certainly appears to have a solid marketing strategy and financial clout, but does it have IP clout? And should key competitors be worried?

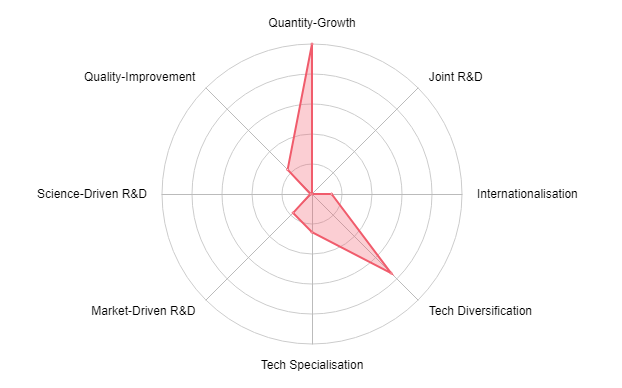

Under Armour’s IP Strategy Radar

A top level overview of UA’s IP strategy shows a high share of tech diversification within its patent portfolio which is growing year by year. But there also appears to be relatively little improvement indicated.

Why would a global sportswear business need science driven R&D? Can it shy away from joint R&D? Not pay much heed to market demand? And avoid internationalisation?

Looking deeper into IP data often reveals much more insight than first impressions can provide.

Tech Diversification and specialisation

All-time patent filing

148 of Under Armour’s 430 patents are designs. These design patents can be useful in identifying the types of product UA is planning to bring to market.

Footwear/shoes are referred to in the title of 61 individual applications for design. And overall there aren’t any major surprises appearing in this list of 148 patents.

Although it is worth noting, at this point, that there are 5 design patents referring to a ‘display screen with graphical user interface’.

The remaining 292 patents are split into utilities and inventions—a utility patent is typically an invention that protects a smaller inventive step.

UA names over 318 different international patent classification (IPC) codes across this remaining portfolio. This helps validate the initial impression of high technological diversity.

Key technologies

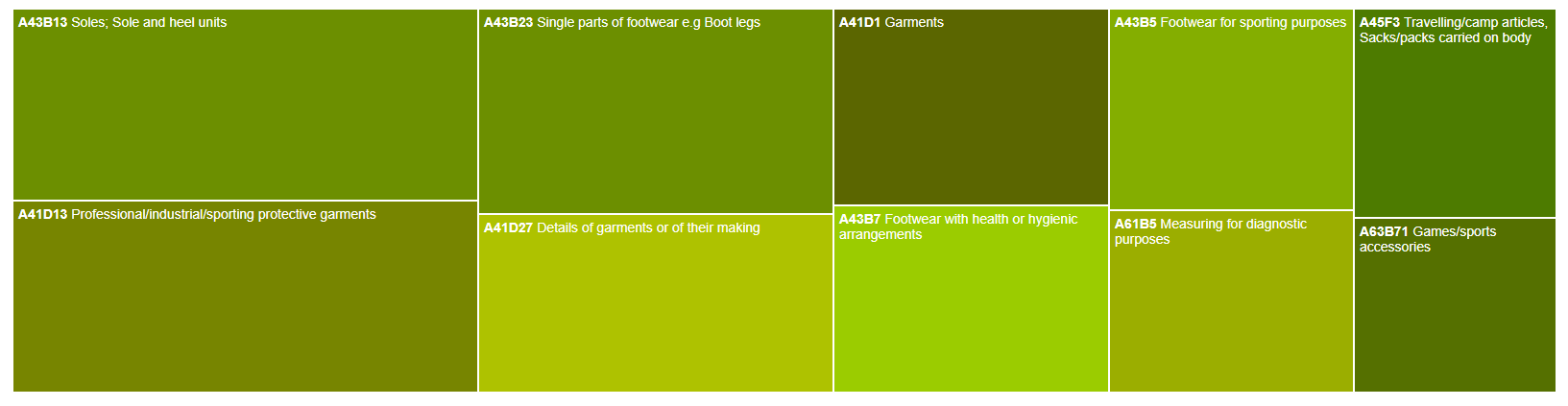

The comparative footprint of UA’s top ten technologies focuses on IPCs A43 and A41. These relate to footwear and clothing, respectively, and one or both feature in 170 (58%) of UA’s remaining patents. Which all makes perfect sense for a company primarily known for its sports clothing.

This is helpful for determining UA’s core competencies and where it has allocated the most resources. With well over half of UA’s non-design patents featuring IPCs A41 and A43 this also explains the analysis of moderate specialisation.

However, there are 2 IPC groups, G and H, that sit below the headlines that may reveal more insight into UA’s future direction and perhaps explain the graphical user interface design patents.

Science-driven R&D

Let’s get physical

In 2013 UA purchased the digital app maker MapMyFitness. Two years later MyFitnessPal and Endomondo—two of the leading fitness and lifestyle apps—became part of the UA portfolio.

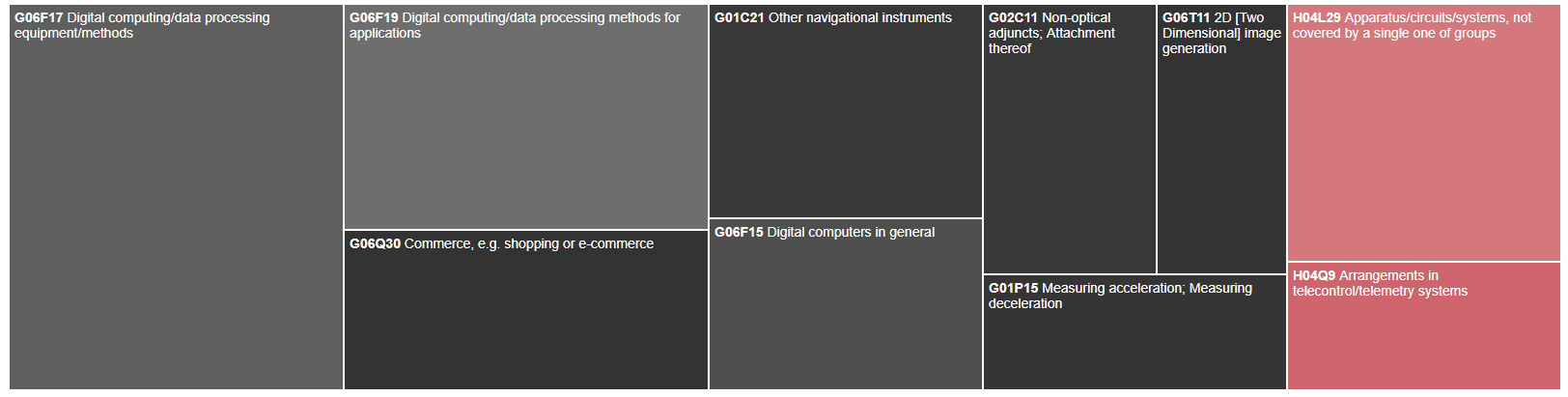

IPCs starting with G relate to physics and cover 54 of UA’s patents. Two of these patents are looking at speech recognition within nutrition and recipe identification patents. 11 come under ‘measuring or testing’ methods—such as speeds, direction and more. And 38 come under the loose header of computing and counting.

IPCs starting with H relate to electricity and cover 17 of UA’s patents. The core of these focus on electronic communication techniques.

And with a narrowed down search looking at the words described in patents including IPC codes G and H—it doesn’t take much to identify a clear intent to penetrate the wearable/trackable market.

Market-driven R&D

Innovation following market trends for smart sports apparel and tracking sensors

IP data isn’t a crystal ball—but it can often anticipate the future.

In early February 2018, Under Armour released the HOVR—smart running shoes with a built-in sensor to measure cadence, distance, stride and steps. Of course, you’ll need an app to connect to the smart sensor—UA’s MapMyRun app. Ta-da! The parts all begin to click into place.

You may say that all of this is obvious after the release of such a product—however many of these patent documents have been available well in advance of the HOVR’s launch. This flowchart details a system with multi-axis athletic performance tracking – US9734389, which was published in August 2017.

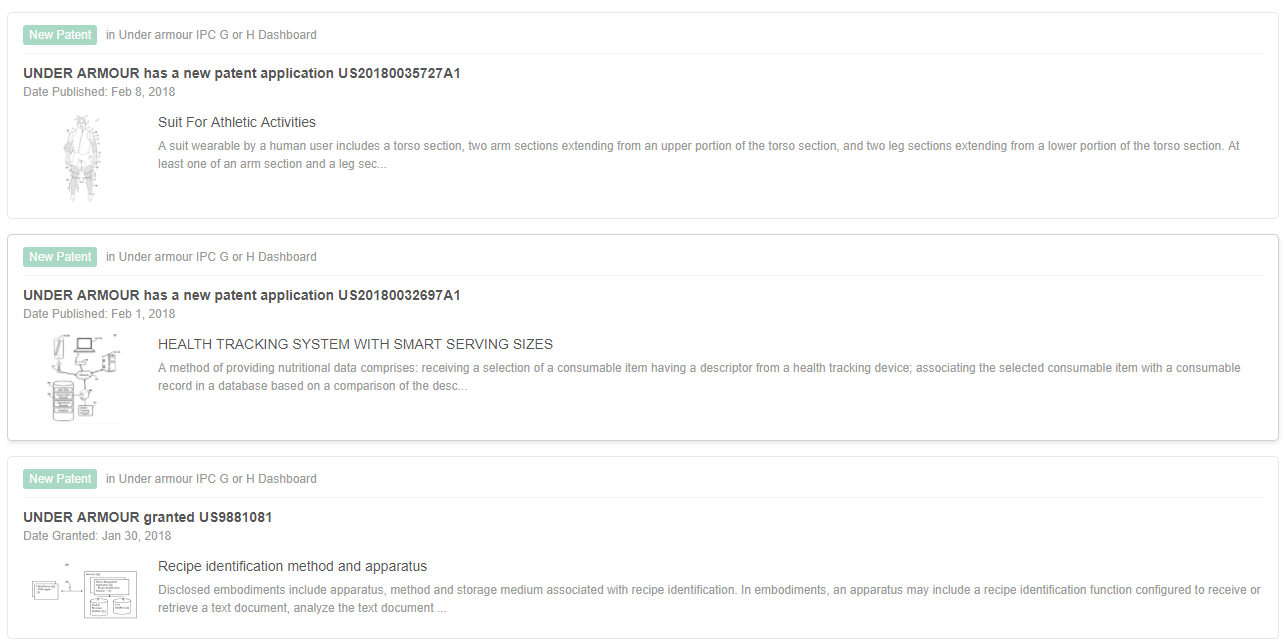

Could UA’s latest published patent applications give us some insight into what’s next?

Quantity and quality—Growth and improvement

A disciplined approach to patenting

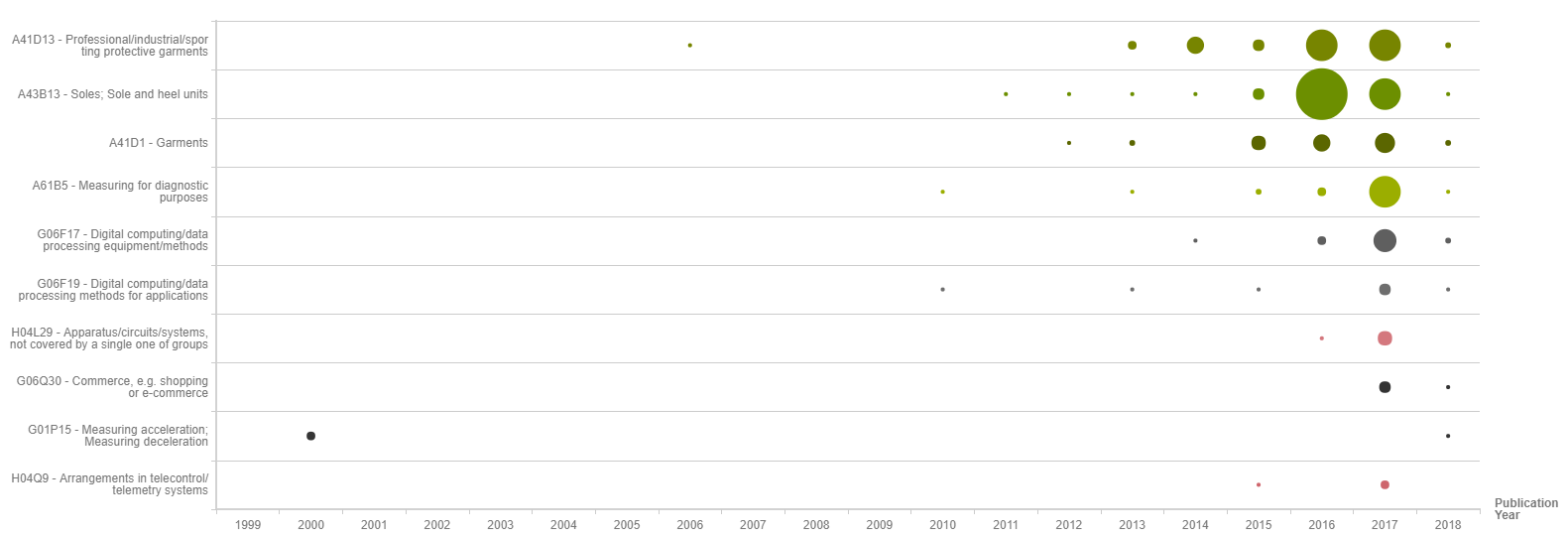

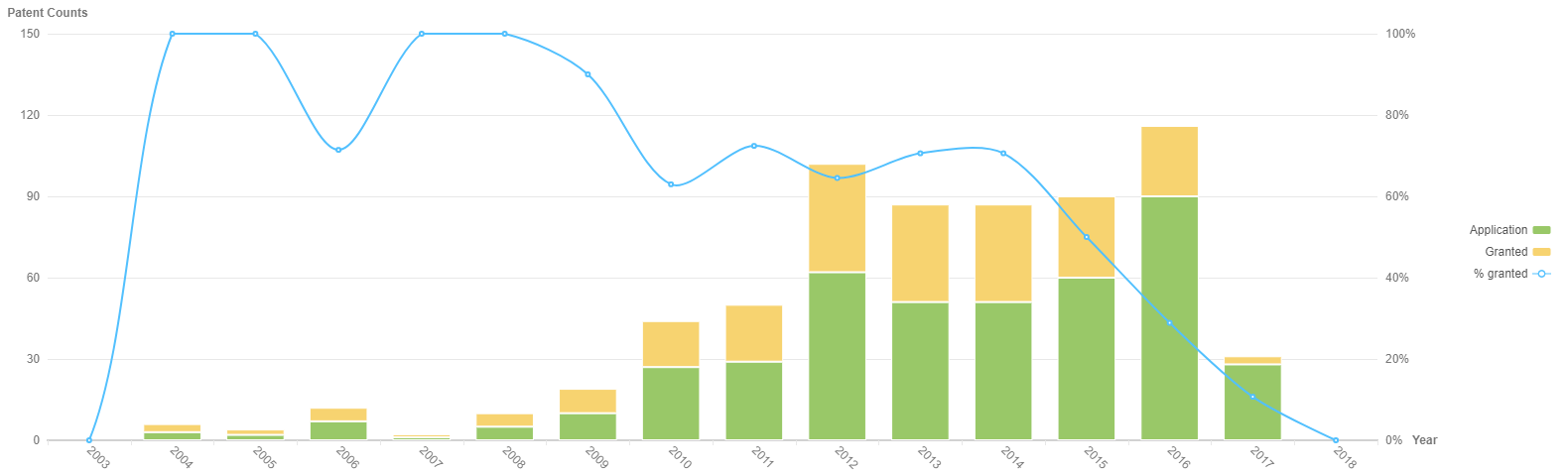

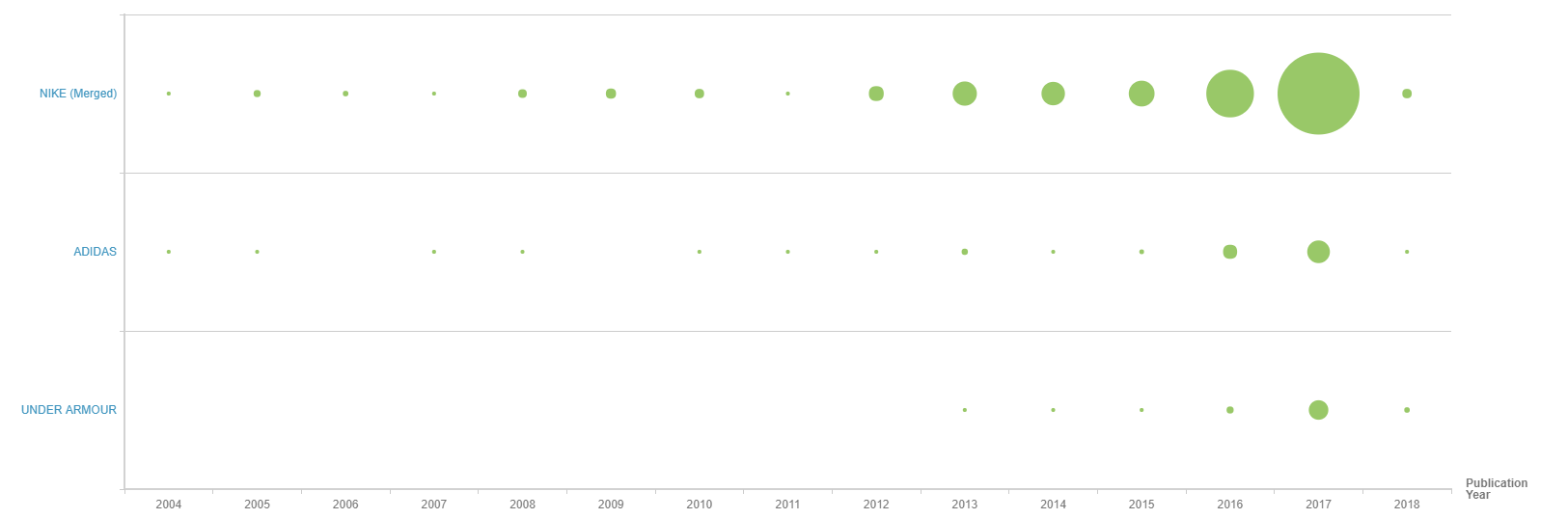

We can see that Under Armour’s patenting activity has grown over the past few years. This graph shows the yearly patenting trend of published patents by technology areas.

The size of the circle represents the number of patents filed in that particular year. UA’s patenting applications for its top IPCs are still on an steady upward trajectory.

But again, looking at the underlying G and H IPCs we can see a relative upsurge in patenting activity in the last 2 or 3 years. Interestingly, that outlier cluster of 3 patents under G01P15 (from 2000) are patents acquired by UA in 2014. They all refer to speed, spin rate and curve measuring using accelerometers and radio transmitters to communicate with a user interface. Is this the tech that is powering the HOVR’s central nervous system? If so, there’s only around 18 months until this patent expires—which means competitors could begin to build on the existing invention without fear of infringement in the not-too-distant future.

It’s also worth noting that some patent applications made in 2016 or later may still be pending publication.

Here we can observe Under Armour’s patenting pace and effectiveness of filing. In the early years of activity UA had a very measured and modest patenting strategy, but as the business has grown, so has its willingness to protect its intellectual property.

The general increase in patent applications has seen a moderate drop in grant rates—dipping below 50% for the first time in 2015—as UA seeks to put down an IP marker. It’s worth noting that 19 of the 60 patents applied for in 2015 are still pending so that grant rate could still increase.

Internationalisation

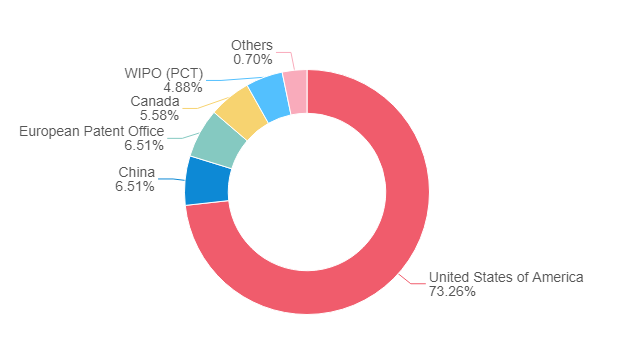

A US sportswear company with worldwide appeal—but not patenting globally

Under Armour is playing on a global platform but has minimal filings outside of the US—choosing to only file around a quarter of their IP in alternative juristictions.

Which means there is potential for some of Under Armour’s intellectual property to be appropriated and replicated outside of its protected regions.

Competitive Landscape

Under Armour’s key competitors – Identifying companies sharing common ground

Under Armour are principally defined as a manufacturing company of sports clothing, apparel and footwear. Knowing that UA is making strides into activity tracking tech means companies such as Strava, Fitbit, Garmin and Suunto should now also be considered on the competitive radar. But for now we will look at the obvious key competitors in UA’s wider marketplace—Nike and Adidas.

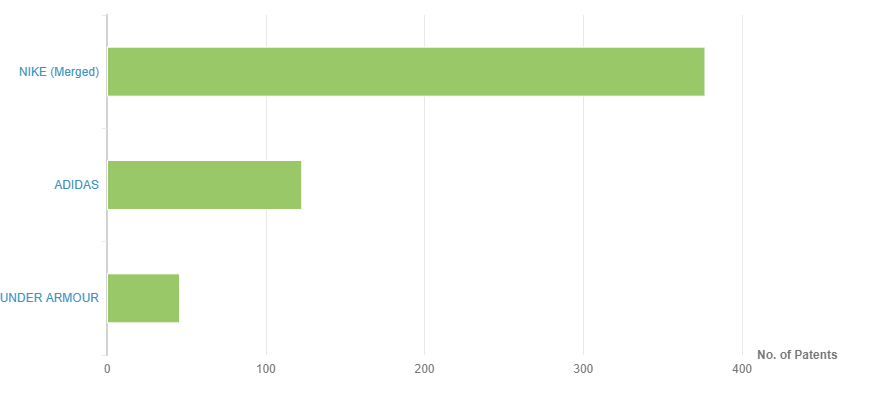

Financial and patent portfolio comparative overview

UA is certainly no slouch in terms of sales. But Nike’s annual revenue dwarfs that of UA by nearly 7 times. And Adidas outsell UA by over 4 times. Once we look at the patent portfolio size and value, that gulf widens even further. But it is also worth remembering that Nike has 54 years of experience and Adidas will be 94 this year.

Staying focussed

Adidas and Nike are no strangers to sports apps or associated tech. Recent developments include Adidas’ buy-out of the Runtastic App in 2015—it’s already announced plans to kill off the legacy miCoach service and migrate existing users to the Runtastic platform. And Nike has teamed up with Apple to launch a takeover version of the Apple Watch Nike+. With this in mind, we’ve kept our attentions focussed on patents that refer to International Patent Classifications G or H—and with a little refinement we are left with a manageable and more focussed portfolio of just 546 patents.

Increased volume and pace

Nike+ goes back over 10 years. A sensor chip that fit into the sole of your favourite running shoes—and connected to your iPod—was one of the earliest offerings. There were critiques on the accuracy of early devices. R&D teams were kicked into action and consequently patenting activity accelerated significantly. Leading to many companies taking steps to improve accuracy, reliability, functionality and user experience.

Steps that Under Armour has presumably put into action with the HOVR.

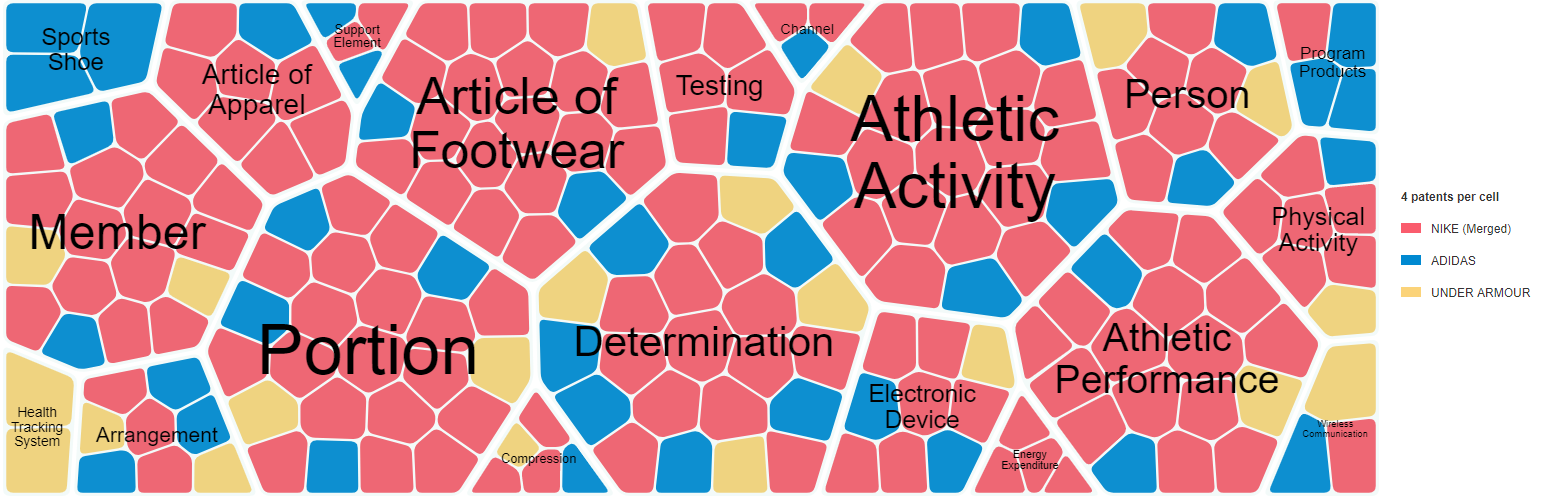

Areas of strength and weakness

Here we can see the main areas of patenting activity by technology field coverage and by company—based on a keyword analysis. This chart can help identify the strengths and weaknesses of the top patentees within this technology area, highlighting areas that may need improvement, as well as potential business or licensing opportunities. The most frequent keywords focus on portion, athletic activity/performance, footwear and determination. And Nike are fairly dominant—which considering the volume of patents they hold is unsurprising. Meanwhile, UA—who are outnumbered around 10 to 1 in terms of patent volumes—have some peripheral areas where they are holding their own including health tracking and wireless communications.

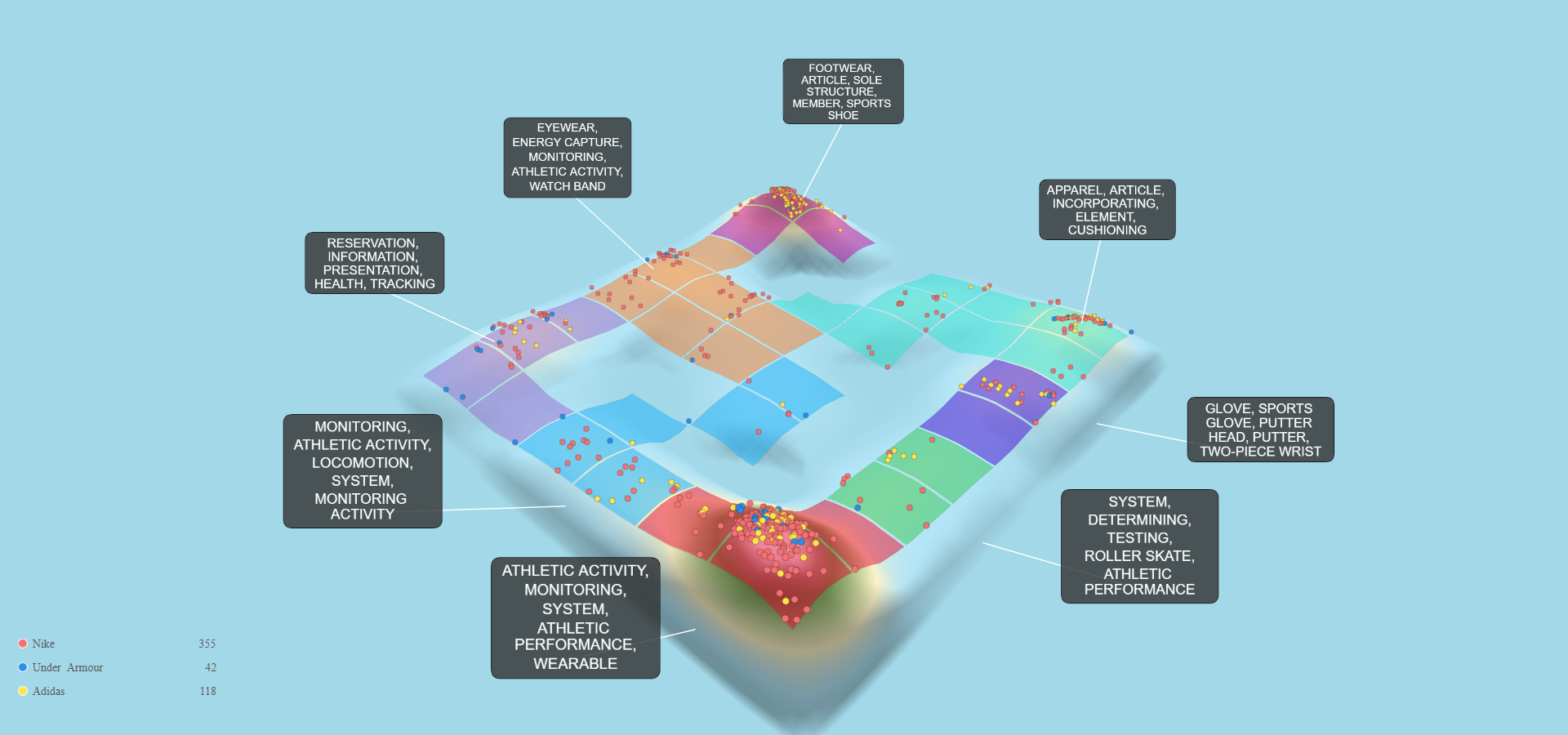

Identifying gaps in the market

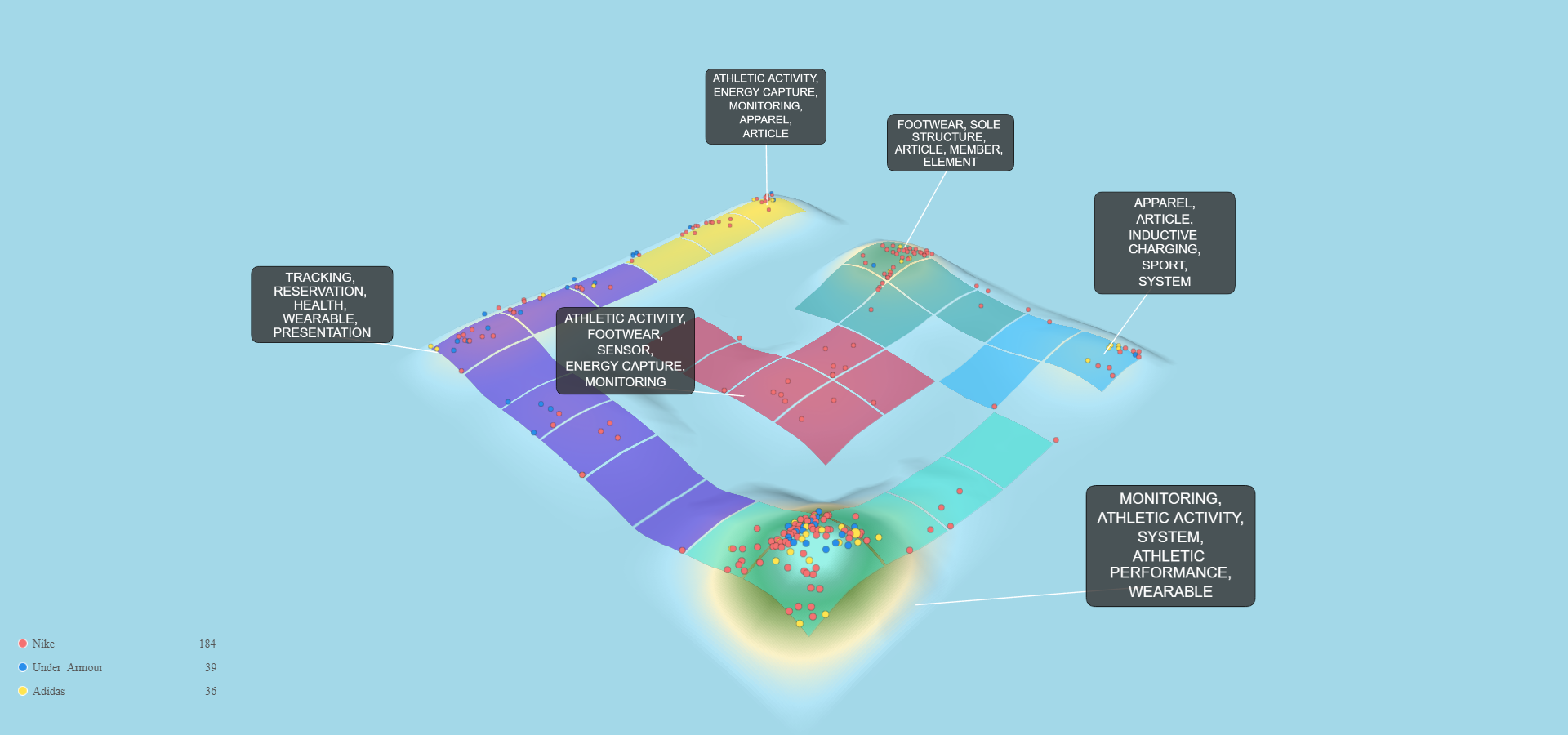

Plotting patent data on a 3D landscape allows us to identify isolated space and areas with high densities of operation.

Elevated topography shows technology segments with high level of innovation activity. Meanwhile, low areas reveal white space with potential for exploitation. In particular, low-lying spaces between areas that have already experienced activity.

By isolating patents that have been applied for in the past 5 years we can observe an alteration to the landscape. And it feels like Under Armour are starting to stand shoulder to shoulder with over a century of prior experience combined.