GLP-1R Race in 2025: 8 Essential Takeaways Drug Developers Need to Know

Currently Playing Post:GLP-1R Race in 2025: 8 Essential Takeaways Drug Developers Need to Know

In late 2025, a seemingly narrow advertising dispute told a much bigger story about the GLP-1 market.

Novo Nordisk’s challenge to Regen Doctors’ promotional claims for compounded semaglutide led the telehealth clinic to voluntarily withdraw its superiority and safety claims. At the same time, as Fierce Pharma has noted, the rise of compounded alternatives and evolving IP dynamics has introduced parallel supply channels that are reshaping market share, pricing and forecasting for branded GLP-1 portfolios, including Ozempic and Wegovy.

The GLP-1R therapeutics market has surged through the year with no signs of slowing. Clinical wins, safety setbacks, generics pressure, and aggressive IP maneuvering are reshaping the competitive landscape at record speed.

Here are 8 essential takeaways drug developers cannot ignore.

1. The market is hotter than ever

The already overheated GLP-1 market showed no signs of cooling in 2025. The sector experienced a dynamic mix of promising clinical trial results, expanded therapeutic indications beyond weight management, strategic partnerships, as well as emerging safety concerns and intensifying patent disputes with generics entering the fray. Novo Nordisk and Eli Lilly continue to dominate., Although Pfizer discontinued its in-house oral GLP-1 candidate danuglipron in April 2025 following a liver-injury signal, it has doubled back into obesity and GLP-1 with its multi-billion-dollar acquisition of Metsera.

Drug developers need to have a better grasp of market trends to help them make more informed decisions.

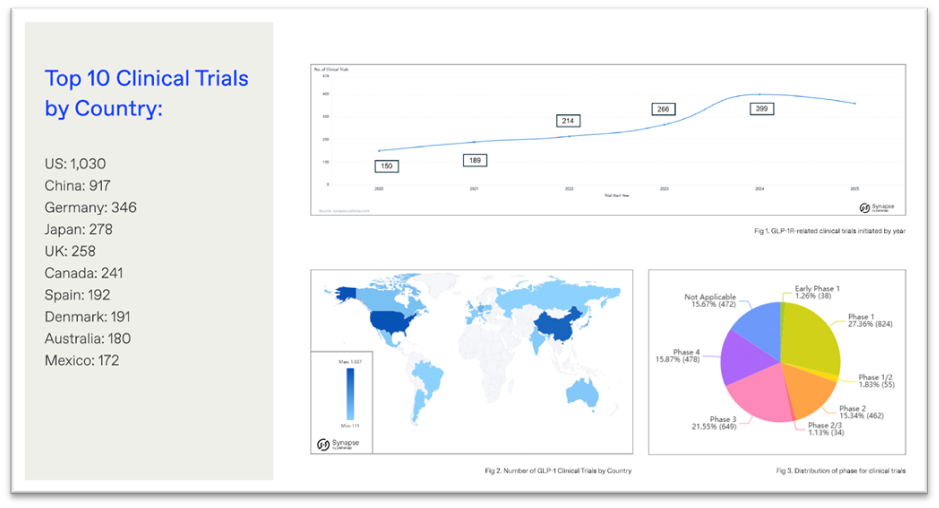

2. Clinical activity is global and accelerating

3. GLP-1 innovation is moving beyond obesity

Drug developers are racing to expand indications to assume market dominance. Keeping abreast of competitive intelligence has never been more critical. Popular targets include Type 1 and Type 2 Diabetes Mellitus, PCOS, CKD, and MASH. Emerging players like Insilico, Kailera, and Fractyl Health are introducing new peptides, tri-agonists, and gene therapy approaches.

4. Small molecule programs remain high risk high reward

Pfizer’s pullback from its own oral GLP-1 programs has highlighted a major scientific challenge: biased agonism can improve GI tolerability but does not eliminate hepatotoxicity risk. Both Danuglipron and Lotiglipron ultimately failed due to liver-related concerns, despite strong oral bioavailability and early promise.

Eli Lilly’s orforglipron continues to advance but has not yet reached benchmark weight loss efficacy. AstraZeneca’s ECC5004 shows a more favorable safety and bioavailability profile with competitive early weight loss. Gilead’s GS 4571 introduces BBB penetration as a new differentiator.

5. Novel modalities are gaining traction

Biologics like antibody peptide conjugates and gene therapy are no longer fringe. Amgen’s MariTide shows approximately 20 percent weight loss in Phase 2 with durable metabolic improvements, signaling a shift toward monthly or lower frequency dosing models.

6. Patent pressure is reshaping strategy

Since 2005, nearly 10,000 GLP-1R related patents have been filed, but the rate of filings and grants is trending downward. Between 2023 and 2045, many key patents will expire, opening the door to generics and forcing originators to diversify protection strategies. These include:

- New formulations and delivery mechanisms

- Lower dose, high bioavailability innovations

- Blood brain barrier (BBB) penetrating designs

- New modalities such as ADCs and fusion proteins

Routine FTO checks, composition and combination filings, and route of administration strategies will be essential to maintain advantage.

Book a demo to find out how Synapse can support your drug development and competitive intelligence.

7. Winning will require both safety and efficacy

The next wave of competition will not be driven by efficacy alone. With increasing concern over adverse events across the class, liver safety, cardiovascular outcomes, PK and PD stability, and dose optimized adherence will decide which assets rise to best in class status.

8. APAC is becoming ground zero for future competition

China and the wider APAC region are emerging as critical arenas for GLP 1 development. Shifting market dynamics, regulatory evolution, and rising local innovation mean global players must strengthen competitive intelligence and local partnerships to stay ahead.

Final takeaway

The GLP-1R landscape is evolving faster than at any point in its history. To remain competitive, drug developers must double down on data driven decision making, always-on IP surveillance, rigorous safety validation, and early diversification into new modalities and indications.

Are you ready to ride the next wave of metabolic innovation?

Download our report today to explore how you can benefit from Patsnap’s real time intelligence across the GLP-1R frontier.