A Value-Based Patent Levy: Preparing for the Biggest Structural Shift in U.S. IP Management Since 1836

Policy teams inside the U.S. Commerce Department are weighing an annual fee tied to each patent’s market value. Early Treasury models point to tens of billions in new revenue, and The Wall Street Journal labels it a paradigm shift. Details remain fluid and Congress must still weigh in, but patent managers already share one question: How do we prepare if this becomes law?

Imagine a single drug-delivery patent valued at $50 million. If lawmakers set the levy at 3%, next year’s bill would reach $1.5 million. Twelve months later, the patent survives an inter partes review or lands a blockbuster licensing deal, doubling its value to $100 million, therefore lifting the levy to $3 million. Seeing that swing in real time turns a nasty surprise into a planned line item.

The problem with single point valuations

A Bloomberg Law article recently summed patent valuation up in two words: “voodoo science.”

A patent can look worthless to one expert, worth a billion to another, and both will marshal spreadsheets to prove their point. Why does the figure swing so wildly? Four restless data currents keep pulling it in opposite directions:

- Commercial performance (volume, price, share)

- Licensing economics (rate ladders, milestone triggers)

- Legal posture (litigation, PTAB reviews, overseas challenges)

- Technical momentum (citation bursts, family growth, rival filings)

Each cluster jolts the classic valuation lenses in its own way:

| Lens | What can move the needle overnight |

| Income (discounted cash flow) | sudden sales jumps, royalty escalators, cheaper capital |

| Market (comparable deals) | fresh licenses, headline verdicts, new M&A multiples |

| Cost / options | faster substitutes, shifting R&D spend, shorter time-to-market |

If regulators anchor the fee to market value, every new datapoint above nudges the levy. Manual refresh cycles of once every few years will not keep pace with whenever the market shifts. The figure will not sit still. First fix the update loop.

Make it fair and repeatable: scorecards and benchmarks

Consider a proven solution that’s already being used in the market by the C-Suite, lenders and investors – look no further than Metis Partners who have a proprietary IPSCORE (some call it the FICO score for IP) which is a proven benchmark, rating companies across 5 IP asset classes: Patents, Brands (incl TMs) Software, Critical Data, and Trade Secrets.

The solution is not a bigger spreadsheet. So why not use an independent benchmark like an IP scoring benchmark that’s trusted by C-suite, lenders and investors. With over 20 years of experience in IP, Metis’ proprietary, proven IPSCORE provides a more reliable benchmark, as well as actionable IP insights and company-specific narrative that is more transparent than ‘valuation voodoo’.

Quantitative pillars to map

- Forward citation velocity and age-normalized impact

- Claim breadth and dependency depth

- Standard-essentiality likelihood with documented thresholds

- Prosecution outcomes and time to grant

- Maintenance behavior and fee survival curves

- Network centrality in citation graphs

Qualitative pillars to map

- Technical merit rubric with four anchor levels

- Market relevance rubric tied to real use cases

- Litigation posture notes with evidence tags

Scorecards reduce argument by isolating evidence from opinion. Let finance price assets later if needed, but do not turn product decisions into a valuation committee fight.

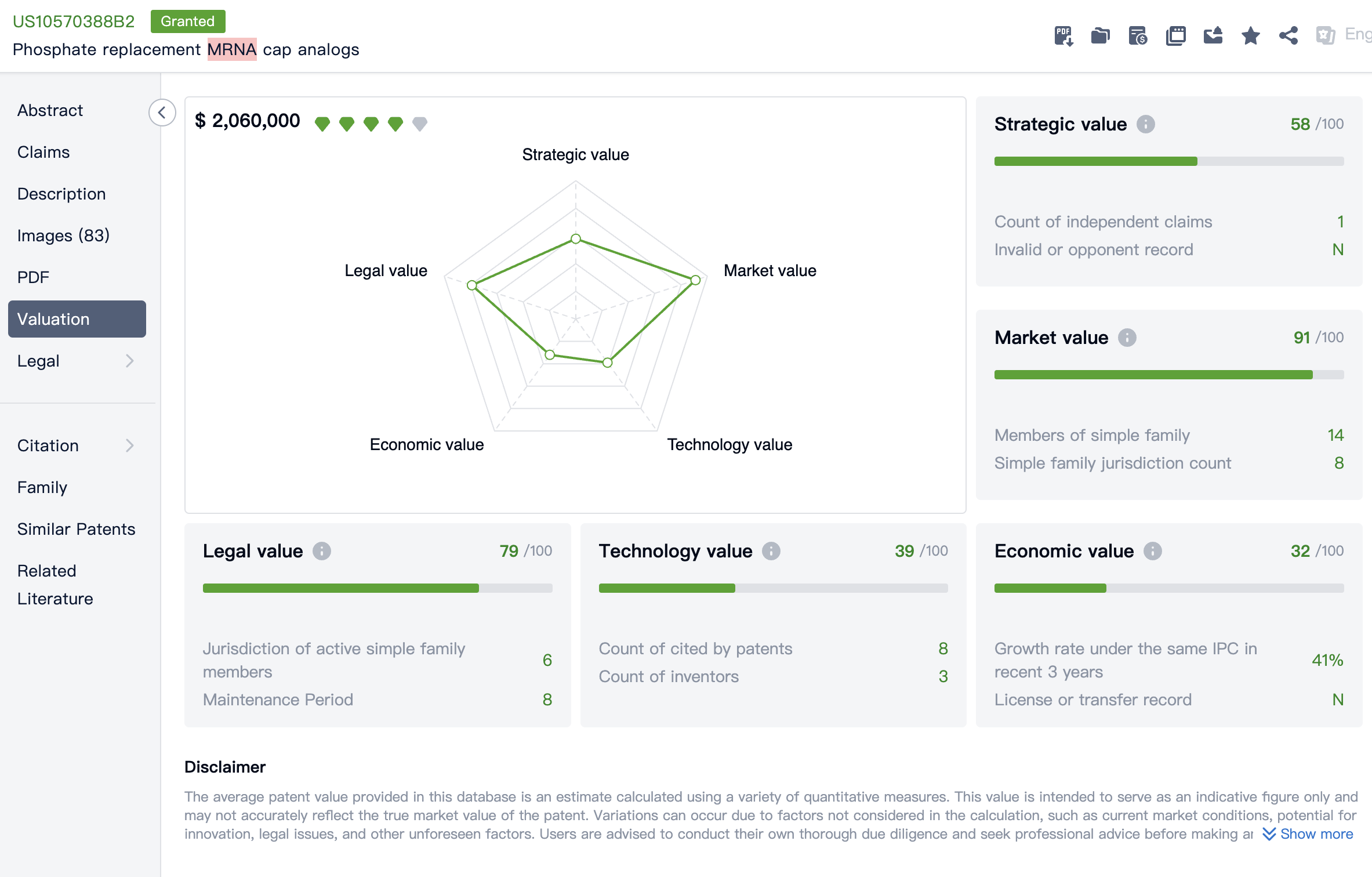

Why you’ll need real-time, AI-driven analytics: the 75/25 model

Use AI for the first read, then experts for the official answer. Platforms such as Patsnap automate about 75% of the work. They capture real-time signals, recalculate models as new data lands, and log every input and weighting to create a near-instant benchmark that correlates with expert scoring. Specialist teams like Metis Partners then deliver the final 25%, fine-tuning assumptions, probing edge cases, and applying their proprietary proven scoring so the result stands up to investors, lenders, and regulators time after time.

AI covers the first 75%

- Sheer volume. A global portfolio produces office actions and licensing tweaks around the clock. No human team can watch every docket entry or citation spike.

- Knock-on effects. A sales spike often pulls litigation risk higher. Machine learning catches chains that linear spreadsheets miss.

- Auditability. Explainable algorithms store sources and weightings, giving a clean line back to raw inputs.

Experts deliver the final 25%

Once AI has surfaced timely insights, expert teams step in to add strategic rigor:

- Precision modeling: Turn AI outputs into transparent, audit-ready valuations that satisfy investors, lenders and regulators.

- Edge-case mastery: Stress-test complex deals, overlapping patent families, and nascent tech clusters where models cannot go alone.

- Strategic context: Infuse insight on competition, regulation, and roadmaps that data alone cannot resolve.

In the course of our IPSCORE engagements, we have consistently observed a strong correlation between Patsnap’s indicator-based patent valuations and our proprietary IPSCORES. This alignment reinforces the credibility of our proprietary scoring framework and its value as a trusted tool and indicator of IP strength. As AI increasingly handles the foundational analytics, our team is able to focus on translating those IPSCORES into valuable insights to inform commercial decisions for our clients, their lenders and investors.

Stephen Robertson, CEO, Metis Partners

This AI plus expert partnership means you never choose between speed or depth; you get machine-speed insights, a rock-solid audit trail, and a single view where IP, finance, and strategy make the same call. With scores that are public, reproducible, and up to date, a value-based fee becomes a budget line, not a boardroom fight.

AI won’t erase uncertainty, but it trims reaction time. That agility turns a value-based fee into a controllable cost instead of a last-minute scramble.

The bottom line

No one can say whether Congress will green-light a value-based fee. What is certain: the data you need already exists, and modern analytics surface it instantly. The task now is to establish a consistent, auditable scoring and valuation standard before any debate turns to law. Patsnap captures the commercial, legal, and technical signals in real time and builds a defensible first view. As IP valuation experts, Metis Partners utilises a proprietary proven scoring benchmark, as well as expert judgment, adding breadth, depth, IP insights and company-specific narrative to the official answer. Put this framework in place today, and any future levy becomes a budgeted cost, not a last-minute shock.