Biotech Investment Trends in 2023

In 2022, the global biotechnology market was valued at $1.37 trillion. From 2023 to 2030, it’s expected to reach a compound annual growth rate (CAGR) of 13.96%.

In this article, we’ll explore the biotech investment trends of 2023 to understand what lies ahead for this dynamic industry.

Jump to . . .

- What is Biotechnology?

- What are Biotechnology Investments?

- VC Investment Trends

- The IPO Market

- Licensing Trends

- The ‘Omics’ Revolution

What is Biotechnology?

Biotechnology is a cutting-edge field of science that harnesses the power of living organisms, cellular components, and biological processes to create innovative solutions for a wide range of industries. It involves using biological systems and techniques to develop and improve products, processes, and services for various applications.

At its core, it merges biology with technology, enabling scientists to manipulate and modify living organisms at the molecular level. This multidisciplinary approach encompasses various subfields such as genetic engineering, bioinformatics, molecular biology, and synthetic biology.

What are Biotechnology Investments?

Biotechnology investments refer to financial allocations made towards companies, projects, or initiatives operating in the biotechnology sector. These investments can take various forms, such as equity investments, venture capital funding, private placements, or public offerings, depending on the specific stage of development and the nature of the biotechnology endeavor.

Investing in biotechnology entails recognizing the potential of biological advancements and the commercial opportunities they present. Biotechnology companies typically leverage scientific research and technological innovations to develop novel drugs, therapies, medical devices, agricultural solutions, or other bio-based products and services.

2023 Biotech Investment Trends

1.) VC Invest Trends

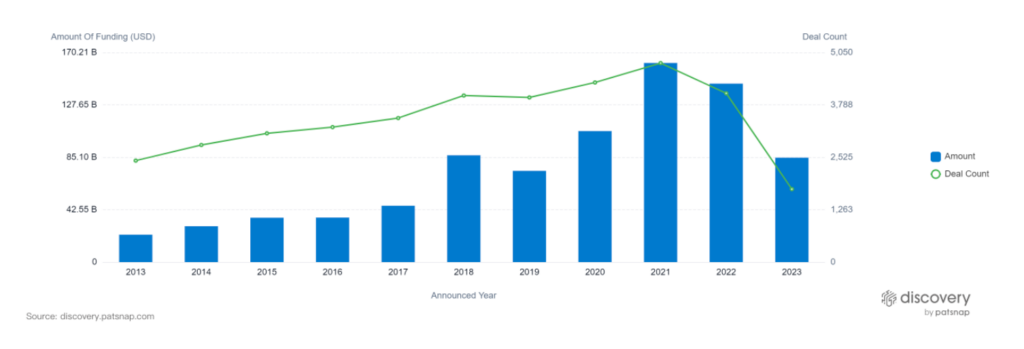

The biotech industry experienced a surge of venture capital (VC) investment in 2021 and 2022, showcasing an unprecedented level of enthusiasm and confidence in the industry’s potential.

Although there was a slight investment decline in 2022, particularly in oncology and neurology, a report from Silicon Valley Bank highlighted that the number and value of investments remained above 2020 levels, indicating a degree of resilience. This decline could also be attributed to investors allowing their previous investments to mature before backing new companies in the same areas.

2.) The IPO Market

The central question on investors’ minds is whether the biotech industry will replicate the explosive growth experienced in 2020 and 2021. BioPharma Dive data reveals that over the span of two years, more than 180 companies went public, while only 22 achieved the same feat in 2022.

This slowdown can be attributed to existing public companies struggling to maintain their value, coupled with clinical and regulatory setbacks, as well as macroeconomic factors that have dampened investor confidence.

Some believe that a return to a more measured pace of IPOs observed in previous years could be beneficial for the industry, given the abundance of cash-burning companies. The decision of companies to embark on their Wall Street debuts hinges on market performance and investors’ appetite for risk, as noted by analysts at BMO Capital Markets in a December report. Additionally, young biotechs and their backers may find dealmaking more appealing in the absence of an easy IPO path.

According to Dusan Perovic, a partner at Two Sigma Ventures, the rate of dealmaking is expected to accelerate in 2023, as numerous large pharma companies actively explore potential partnerships and deals with startups. The environment appears much healthier compared to 2022.

3.) Licensing Continues Despite Mixed Market Projections

With mixed market projections concerning overall licensing in 2023, investors will closely scrutinize collaborative efforts this year. However, notable biotech licensing deals are already underway.

Moderna and CytomX: Moderna, renowned for its messenger RNA coronavirus vaccine, signed a collaboration agreement with CytomX Therapeutics to expand its presence in the oncology sector.

Under the agreement, Moderna will make an upfront payment of $35 million and a $5 million pre-paid research funding investment. CytomX stands to receive up to $1.2 billion if specific milestones are achieved. While CytomX focuses on drug discovery and preclinical assessments, Moderna will concentrate on clinical development and commercialization following FDA approval.

Lilly and Sigilon: Eli Lilly announced its plan to acquire Sigilon, a biopharma company developing encapsulated cell therapies, for $34.6 million. The announcement led to a staggering 691.1% surge in Sigilon’s stock on the morning of June 29, 2023.

The acquisition aims to advance SIG-002, an investigational therapy with the potential to provide long-term insulin production and blood glucose control for individuals with type 1 diabetes. Lilly and Sigilon have collaborated since 2018 to develop encapsulated cell therapies for diabetes.

4.) The ‘Omics’ Revolution

The burgeoning field of ‘omics’ has garnered over $2.4 billion in venture funding by December 2022, as per Crunchbase data. Funding for startups delving into the intricacies of cellular analysis to understand the root causes of diseases and develop effective treatments has nearly tripled since 2019.

The pandemic catalyzed advancements in omics, such as rapid diagnostic tests and the groundbreaking mRNA COVID-19 vaccine. Even Amazon ventured into the omics space with its introduction of Amazon Omics.

The omics field encompasses genomics, metabolomics, proteomics, and transcriptomics. What sets omics apart is its potential to revolutionize the medical landscape. Rather than relying on traditional parameters like blood pressure or body temperature, doctors will be able to delve into each patient’s individual cells, paving the way for personalized medicine.

In conclusion, the biotech industry continues to evolve and present exciting opportunities for investors and innovators alike. With record levels of VC funding, fluctuations in the IPO market, notable licensing deals, and promising advancements in the ‘Omics’ field, the path ahead is full of potential.

Your recommended content

-

All Charged Up: Power Batteries & The Patent Race Shaping the Future of Electric Mobility

Category: Article | Category: battery technology | Category: electric vehicle | Category: EV | Category: lithium ion | Category: lithium ion battery | Category: NEV | Category: new energy vehicles

Monday, April 22, 2024

In the ever-evolving landscape of innovation, the electric vehicle (EV) industry stands as a beacon of technological transformation. As we explore the patents propelling the EV revolution, Apple's venture serves as a poignant example of the challenges even industry giants face in this competitive arena. Join us on a journey through the global patent landscape, where the quest for superior power solutions unfolds, and where the true pioneers of the EV revolution are making their mark.

-

The People vs. AI: Who Owns Ideas in the Era of Generative Artificial Intelligence?

Category: AI era | Category: AI-driven creativity | Category: AI-generated creations | Category: Article | Category: copyright and patent rights | Category: digital innovation | Category: innovation | Category: intellectual property law | Category: legal implications | Category: OpenAI Sora | Category: patent law | Category: Research Tag | Category: Sora | Category: text-to-video generative AI | Category: who owns AI

Monday, April 22, 2024

OpenAI’s Sora software, a text-to-video generative AI model, recently made headlines showing a series of 1-paragraph prompts and some high-quality footage generated based on those prompts. It is a rightfully impressive showing, but it’s still too early to identify how IP law will be disrupted by generative AI. This editorial delves into the multifaceted landscape of Sora's impact, offering insights into the future of innovation and ownership in the AI era.

-

Patsnap Releases 2023 Global Innovation Report: The Brilliant Names to the Dynamic Landscape of Innovation

Category: Article | Category: eBook | Category: Research Tag | Category: Whitepaper

Wednesday, November 15, 2023

The Global Innovation 100 and Global Disruption 50 transcend individual entities, each representing a small innovation ecosystem with numerous subsidiaries. Through the innovation data of these companies, we gain insights into the characteristics, structures, and trends of global innovation.